Why Pepper?

By providing a universal interface, our Pepper software makes it easy to connect POS terminals to your cash register software.

Why Pepper?

By providing a universal interface, our Pepper software makes it easy to connect POS terminals to your cash register software.

POS terminal assistant

Find out whether your terminal is supported by our solutions.

Supported POS software

Find out whether Pepper has already been integrated into your POS system.

Order a Pepper license

Ready to purchase your Pepper license?

Why Matchbox?

Matchbox automates your payment reconciliation, reduces expenditures – and turns the flood of your payment data into informative diagrams.

Free Matchbox trial

Give Matchbox a try? We would love to give you a short personal introduction and then activate your free trial account.

Supported terminal types

Find out whether your terminal is supported by our solutions.

Check now

Supported POS software

Find out whether Pepper has already been integrated into your POS system.

Check now

The driving force worth knowing

As EFT experts, we not only report on current projects here. We also like to share our knowledge about the world of cashless payments.

17 December 2020

Digitisation is changing, making many areas of the working world much simpler. This also applies to accounting. Piles of paper folders are replaced by digital receipts, software automates the postings, and analysis tools simplify the evaluation. Find out how your company can benefit from digital accounting, what the challenges are and how to practically manage the transformation process.

Digital accounting comprises the digitisation of relevant invoices and receipts (e.g. using a scanner), their transfer into digital accounting systems and, to some extent, even the automation of the respective bookings. In addition, the digitisation of the financial accounting serves as a basis for an automatic evaluation (key figure analysis).

As part of digitising their accounting, more and more companies switch to purely digital receipts and invoices (e.g. as a PDF) in order to avoid the time-consuming scanning of paper receipts.

Especially smaller businesses often manage their bookkeeping manually: Receipts are collected in paper form and then sent to the tax advisor or auditor by post – which takes a lot of time and money.

German legislation eased the format requirements for tax documents with the 2011 VAT Act, which measurably accelerated the digitisation of accounting there. The same applies to legislative adjustments in Switzerland and Austria. Since then, especially larger companies, but also many start-ups, have discovered the potential of digital accounting.

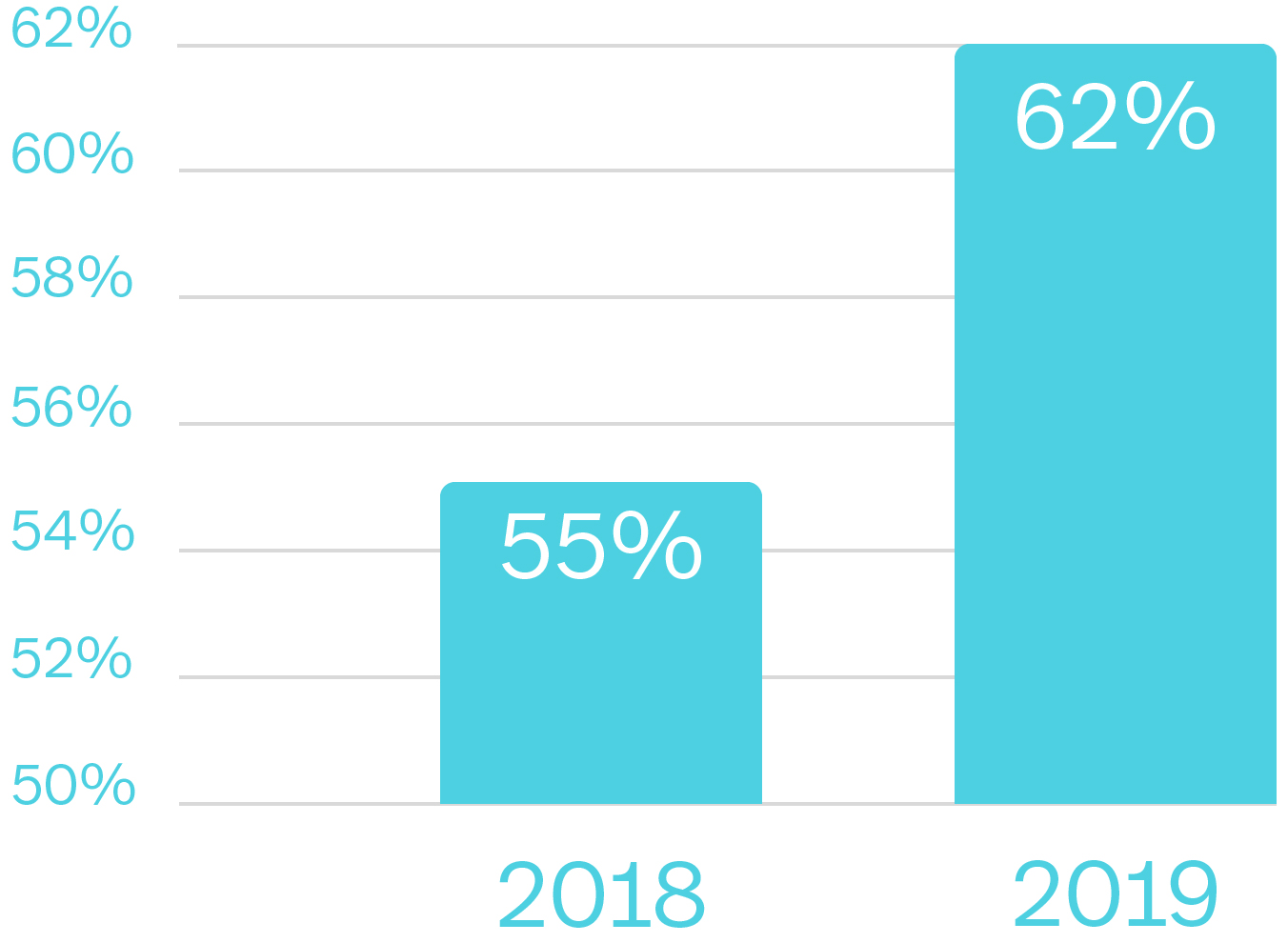

A study by KPMG from 2019 shows how quickly digitisation is advancing in this area.

Digitised accounting shows a whole range of potentials, but it also comes with plenty of challenges for companies. We have put together the most important advantages and challenges.

Digital accounting simplifies and speeds up the workflow in accounting, as the reconciliation of payment information and posting can be automated based on the digital data.

Here software such as Matchbox by treibauf comes into play. This solution first imports data records from cash registers (POS) and card processors to match them fully automatically. Then the determined data is reliably exported as transaction-accurate accounting records into the company’s accounting system.

With newer accounting systems, postings are also fully automated.

Especially for more complex posting processes, such as the posting of PayPal payments, digital accounting saves a lot of time, takes much less effort and even makes room for new capacities.

In addition, digital accounting allows for more data security and transparency in accounting. The software detects inconsistencies automatically.

Here, too, Matchbox by treibauf is a great example: the software identifies all discrepancies as it compares the data records automatically. So, no more searching for the needle in the haystack!

In that sense, Matchbox not only helps to identify sources of error. The software also ensures more transparency in accounting and a higher quality of data. A reliable data basis, in turn, simplifies reliable analyses and the preparation of key figures in quickly comprehensible graphics.

Digitising receipts and account statements saves a lot of space, time and effort. At an accountant’s office, just think of how much room is taken up by only by shelves packed with folders. With a cloud-based data management, the accountant’s furniture is only so much as a desk and a scanner shelf.

Cloud-based data archiving allows accountants to work from anywhere in the world. . If all relevant accounting receipts and documents can be accessed digitally at any time, employees are no longer tied to their office. They can easily work from home or on the road.

The lockdowns during the COVID-19 pandemic have shown how important it can be to be able to access all data regardless of the location and to able to continue to work efficiently if the situation requires it.

Did you know: 20 million office workers in Germany print out paper equivalent to 1,000,000 trees per year? Digital accounting contributes significantly to paper reduction, which is not only good for the environment, but also for the image of your company.

Of course, switching to digital accounting comes with organisational challenges. For example, all relevant accounting data must be available in digital form to make digital accounting work.

This also means that digital accounting is only worthwhile if the digitisation of paper receipts is a manageable effort. Overall, there should also be a sufficient volume of work to be digitized.

With digital accounting, it is important to comply with all legal requirements for proper accounting. In addition to the conscientious digitisation of paper documents and correct data archiving, this also applies to the use of legally compliant software.

Be extra careful when digitising paper receipts. Fiscal rules for tamper-proof storage must be respected when scanning receipts. You also need to ensure machine readability of the scanned documents.

In Germany, the fiscal rules with regard to digital accounting are regulated by the GoBD, including not only the secure archiving of incoming and outgoing invoices, but also of all documents that might be relevant for tax purposes. The following rule applies: “Tax-relevant documents must be kept in the original, scanned paper documents can replace the original. Not vice versa. PDF invoices must also be kept as PDF.”

Similar regulations apply to other countries. Here we refer to the respective regulations in these countries.

Accounting staff must be trained in the various programmes. Many providers of digital accounting systems offer their clients’ employees trainings to learn the new software tools.

Start-ups are advised to digitise accounting processes right from the start in order to train their own employees from the very beginning and therefore benefit directly from the advantages of digital accounting.

An important issue for tax advisors and accountants is, of course, the security of incoming and exported data. After all, it is highly sensitive internal company information.

With regard to digitised accounting, software is used that meets the highest security requirements and ensures reliable data protection in accordance with EU regulations.

When collecting, processing and using personal data, for example, strict security parameters regulate the access, transfer, availability and organisation of this data to technically exclude any misuse.

So much for context, potential and challenges. But what’s the best way to proceed if you want to digitise your accounting? These are the first four steps.

The software you use should be as intuitive as possible and it should meet the legal requirements of the respective tax office.

In Germany, for example, it should comply with the general principles of proper digital accounting (GoBD). This also implies that the fiscal rules for tamper-proof storage must be integrated in the archiving programmes. Here’s an overview of proven accounting software.

The next step is to train the accounting staff in the various digital programmes and, if necessary, to provide regular further training.

All analogue receipts and invoices must be systematically and consistently scanned to be digitally retrievable from anywhere.

The more business partners participate in the digital transformation, the easier and more cost-effective future cooperation it will be: By transmitting their receipts directly in digital form, they can speed up the process in their own accounting department. Tedious scanning is no longer necessary.

However, make sure that all information is correct. All invoices need to be archived securely for at least 10 years (e.g. in the cloud).

Whether it’s start-ups or corporations: More and more companies digitise their accounting partially or completely.

Digital accounting not only simplifies the workflow in accounting companies by automating payment reconciliation and posting processes. It also ensures higher data security, more transparency, less required space, a more flexible workplace (think of “home office”) and best of all, it protects our environment.

So these are four simple steps how you can best meet possible challenges when digitising your accounting.

21 March 2024 – What do you actually do with your expired debit cards, credit cards and railcards? They’re simply too good to throw away. If you want to quickly make something practical, surprise your colleagues or bring a little light relief to your next customer meeting, we’ve got three upcycling ideas for ... Continue reading

7 December 2023 – «For us Pepper works like a universal adapter, which makes it vastly easier to connect different terminal types», says Rüdiger Boesen, Product Management TCPOS at Zucchetti, summarising his understanding of the software. A general contract was consequently concluded for the DACH region back at the start of the 2000s. Continue reading

4 December 2023 – Having already worked with treibauf for some time, Bächli Bergsport is now also using automated payment reconciliation from Matchbox for its accounting. Discover the motivation behind the company’s decision – and what’s changed since the rollout. Continue reading