Why Pepper?

By providing a universal interface, our Pepper software makes it easy to connect POS terminals to your cash register software.

Why Pepper?

By providing a universal interface, our Pepper software makes it easy to connect POS terminals to your cash register software.

POS terminal assistant

Find out whether your terminal is supported by our solutions.

Supported POS software

Find out whether Pepper has already been integrated into your POS system.

Order a Pepper license

Ready to purchase your Pepper license?

Why Matchbox?

Matchbox automates your payment reconciliation, reduces expenditures – and turns the flood of your payment data into informative diagrams.

Free Matchbox trial

Give Matchbox a try? We would love to give you a short personal introduction and then activate your free trial account.

Supported terminal types

Find out whether your terminal is supported by our solutions.

Check now

Supported POS software

Find out whether Pepper has already been integrated into your POS system.

Check now

The driving force worth knowing

As EFT experts, we not only report on current projects here. We also like to share our knowledge about the world of cashless payments.

17 December 2020

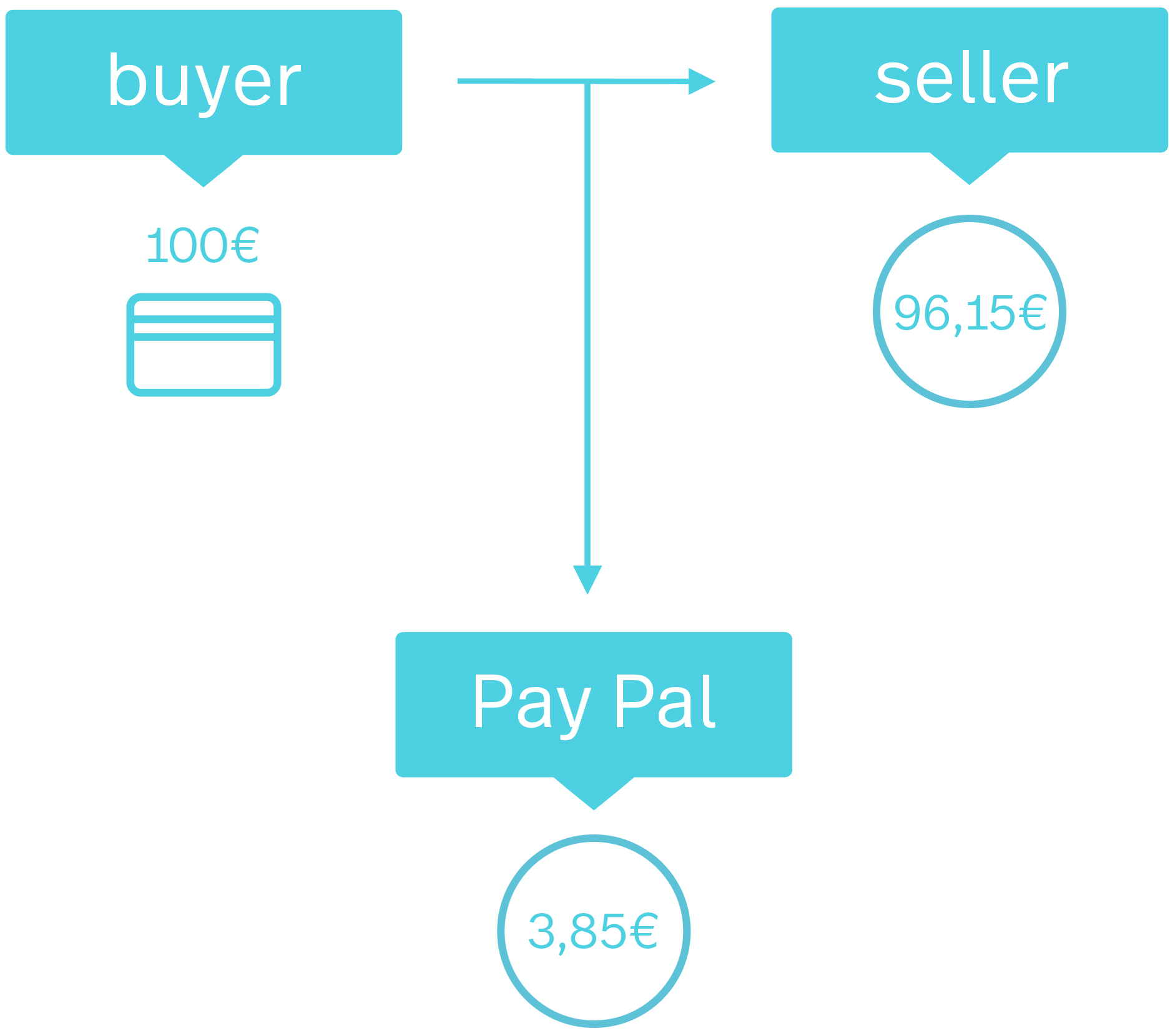

Fast, safe and simple: For buyers, PayPal is becoming an increasingly popular payment method. For retailers, however, PayPal comes with some particularities, especially with regard to accounting for PayPal payments. Find out everything retailers need to consider with PayPal transactions, how to account for them, and how you can reduce your work effort.

PayPal is a popular online payment service, designed to make online purchasing in particular easier and safer. The increased security mainly concerns two special features which also affect accounting.

What’s special about PayPal? Each money transfer is completely settled online. Unlike a regular bank account, a PayPal account is a purely virtual account assigned to an email address. This not only speeds up the payment process, it also has implications for the accounting of PayPal payments.

The PayPal payment option can be embedded on the website as a button or in the retailer’s online shop.

To use PayPal to transfer money, customer and retailer must be registered with an email address. Unlike other cashless payment methods, PayPal doesn’t require any bank or credit card details for identification. This means that neither party discloses their bank details.

If a customer pays with PayPal for a retailer’s product, the respective amount is credited to the retailer’s PayPal account. You should note, that at first the money is held in this virtual account, and not automatically credited to the seller’s bank account. This is quite important for the accounting of PayPal payments.

For the online payment service, PayPal charges a commission that the retailer has to pay. Find out more about the costs for the seller here.

PayPal mainly offers plenty of advantages for the buyer, not least because it makes purchasing processes easier and safer. And the payment service is also beneficial for the seller. There are, however, some disadvantages to this payment method you should bear in mind.

When it comes to PayPal billing and accounting, there are some particularities to consider with PayPal payments. This is partly due to the fees charged to the retailer for each payment, and partly because PayPal accounts are purely virtual. In terms of accounting, however, a PayPal account needs to be managed just like a regular bank account.

Make sure to save and archive statements of all PayPal transactions and retailer account reports. In printed form, they serve as necessary accounting records for the accounting department.

Do not leave incoming payments on your PayPal account for a longer period of time. PayPal can block your account in the event of complaints or if money laundering is suspected. Unblocking the account takes an enormous effort.

Due to the commission that PayPal charges, the amount that arrives on the PayPal account is (automatically) not the original gross price. However, it would be wrong to simply post the actual incoming amount of money as revenue.

Manual accounting of PayPal payments is time-consuming. There’s the accounting of the fees as well as the postings from the PayPal account to the bank account – especially if there are several transactions to be accounted for.

But there are a number of software solutions that offer an interface to PayPal, which can partially automate accounting processes and thus make day-to-day work in accounting much simpler.

One good example is Matchbox by treibauf – the automatic debtor reconciliation in cashless payment transactions.

Even when it comes to PayPal’s lack of support, Matchbox is there to help. Since the software monitors the transfer of data automatically, it quickly identifies all inconsistencies – and Matchbox’s support team is able to respond proactively.

By the way: This is just one of many examples how digitalisation can simplify accounting.

23 April 2024 – There is no excerpt because this is a protected post. Continue reading

21 March 2024 – What do you actually do with your expired debit cards, credit cards and railcards? They’re simply too good to throw away. If you want to quickly make something practical, surprise your colleagues or bring a little light relief to your next customer meeting, we’ve got three upcycling ideas for ... Continue reading

7 December 2023 – «For us Pepper works like a universal adapter, which makes it vastly easier to connect different terminal types», says Rüdiger Boesen, Product Management TCPOS at Zucchetti, summarising his understanding of the software. A general contract was consequently concluded for the DACH region back at the start of the 2000s. Continue reading