Why Pepper?

By providing a universal interface, our Pepper software makes it easy to connect POS terminals to your cash register software.

Why Pepper?

By providing a universal interface, our Pepper software makes it easy to connect POS terminals to your cash register software.

POS terminal assistant

Find out whether your terminal is supported by our solutions.

Supported POS software

Find out whether Pepper has already been integrated into your POS system.

Order a Pepper license

Ready to purchase your Pepper license?

Why Matchbox?

Matchbox automates your payment reconciliation, reduces expenditures – and turns the flood of your payment data into informative diagrams.

Free Matchbox trial

Give Matchbox a try? We would love to give you a short personal introduction and then activate your free trial account.

Supported terminal types

Find out whether your terminal is supported by our solutions.

Check now

Supported POS software

Find out whether Pepper has already been integrated into your POS system.

Check now

The driving force worth knowing

As EFT experts, we not only report on current projects here. We also like to share our knowledge about the world of cashless payments.

9 September 2021

There is no cashless payment without authorisation from an acquiring bank that charges a fee for its service. For this service, 43% of merchants have so far limited themselves to working with a single acquiring bank – partly because integrating different acquirers can involve a great deal of effort. In this article, you will learn what an acquiring bank does, why a multi-acquiring strategy is worthwhile for most merchants, and how you can make it easier to integrate new acquirers.

All merchants who offer cashless payments must conclude a card acceptance agreement with an acquiring bank in advance.

This acquiring bank (also known as an acquirer or merchant bank) authorises or rejects a cashless payment based on the validity of the card and the given credit limit.

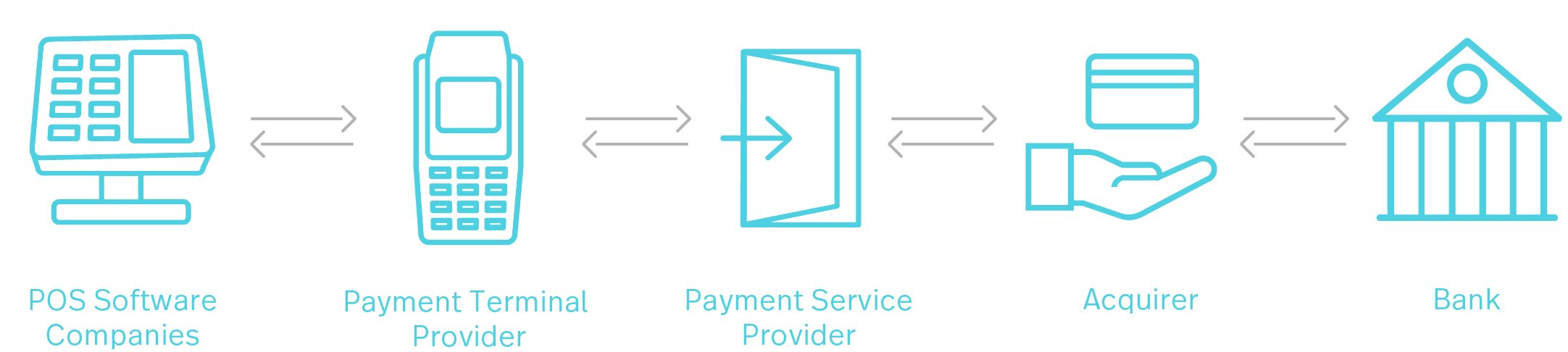

In this role, the acquiring bank acts as an important buffer between the payment service provider (PSP) and the issuing bank.

Find out what roles these and other market participants play in cashless payments and how they interact with each other in our article on cashless payments.

A lock-in effect is a situation where customers find it difficult to switch to another provider due to high switching costs or other obstacles. The higher the switching costs, the greater the lock-in effect.

In order to enable their customers to make cashless payments, merchants must provide the technical infrastructure (card terminal and POS system) and also conclude contracts with a payment service provider (PSP) and (at least) an acquiring bank.

In order for cashless payment to function smoothly, these different areas must be coordinated with each other. This creates organisational and technical dependencies that can make it very complicated for merchants to change acquiring banks.

To avoid these complications, merchants often stay with an acquiring bank despite high fees.

In a multi-acquiring strategy, merchants or payment service providers work with several acquiring banks at the same time so that they are independent of any one acquirer from a technical, legal and commercial perspective.

If multi-acquiring is implemented in your own EFT system, cashless payments can always be processed by the acquiring bank that best suits the relevant card or payment type, or that offers the best conditions.

Wenn es auf Seiten einer Acquirer Bank zu einem technischen Störfall oder Betriebsausfall kommt, kann der Betrieb im Fall einer Multi-Acquiring-Strategie trotzdem reibungslos fortgeführt werden.

The multi-acquiring strategy gives merchants (and PSPs) greater flexibility to respond to their customers’ payment preferences. This flexibility is becoming increasingly important for merchants as more and more different means of payment (such as smartphones and smartwatches) are being used.

With a multi-acquiring strategy, merchants can accept even more card types and currencies. At the same time, those who have to reject fewer payments automatically benefit from a higher conversion rate. By the way: 85% of merchants who have introduced multi-acquiring confirm that this is the case.

In addition, a multi-acquiring strategy means that the payment processing can always be specifically entrusted to the acquirer that offers the best conditions.

This competition gives merchants more bargaining power vis-à-vis acquiring banks – and at the same time frees them from the lock-in effect.

Merchants who want to introduce multi-acquiring must adapt their payment infrastructure accordingly. When it comes to technical integration, Pepper, the universal connection between payment terminal and POS device, makes it much easier to connect new terminals and thus considerably reduces the effort and expense involved.

Several acquirers in parallel – this means that there will also be a variety of different fees (depending on the acquirer contract). The payment analytics centre of the reconciliation software Matchbox helps merchants to keep track of all the structures and fees of the different acquiring banks – and thus optimise their costs.

23 April 2024 – What are the 15 most important KPIs in accounting? And which new KPIs have become more important in the context of electronic payments? Our article provides valuable insights for better controlling. Continue reading

21 March 2024 – What do you actually do with your expired debit cards, credit cards and railcards? They’re simply too good to throw away. If you want to quickly make something practical, surprise your colleagues or bring a little light relief to your next customer meeting, we’ve got three upcycling ideas for ... Continue reading

7 December 2023 – «For us Pepper works like a universal adapter, which makes it vastly easier to connect different terminal types», says Rüdiger Boesen, Product Management TCPOS at Zucchetti, summarising his understanding of the software. A general contract was consequently concluded for the DACH region back at the start of the 2000s. Continue reading