Why Pepper?

By providing a universal interface, our Pepper software makes it easy to connect POS terminals to your cash register software.

Why Pepper?

By providing a universal interface, our Pepper software makes it easy to connect POS terminals to your cash register software.

POS terminal assistant

Find out whether your terminal is supported by our solutions.

Supported POS software

Find out whether Pepper has already been integrated into your POS system.

Order a Pepper license

Ready to purchase your Pepper license?

Why Matchbox?

Matchbox automates your payment reconciliation, reduces expenditures – and turns the flood of your payment data into informative diagrams.

Free Matchbox trial

Give Matchbox a try? We would love to give you a short personal introduction and then activate your free trial account.

Supported terminal types

Find out whether your terminal is supported by our solutions.

Check now

Supported POS software

Find out whether Pepper has already been integrated into your POS system.

Check now

The driving force worth knowing

As EFT experts, we not only report on current projects here. We also like to share our knowledge about the world of cashless payments.

11 April 2022

In late 2021, treibauf partnered with the consultancy Arkwright to conduct the first Swiss EFT Insights – a survey on the structures and costs of cashless payment transactions in Switzerland. In early 2022, we presented the results in a webinar. But why was this survey conducted in the first place? What was examined? And what were the main results? This article answers the most important questions.

Looking at the payment market, there is a clear trend that also applies to Switzerland: more and more customers are paying cashless. As a result, the fees for these cashless payments are also becoming an increasingly important cost factor for businesses.

Nevertheless, for many companies, both the exact composition of these fees and their relative level compared to other market participants remain a «black box» – just like several other key topics.

We want to change this. That is why we have developed the Swiss EFT Insights: a series of surveys intended to bring more transparency to the Swiss cashless payments market. In late 2021, we conducted the first survey. This work also produced recommendations for the sustainable and efficient management of payment services.

We asked the participating companies a series of questions on four major topics:

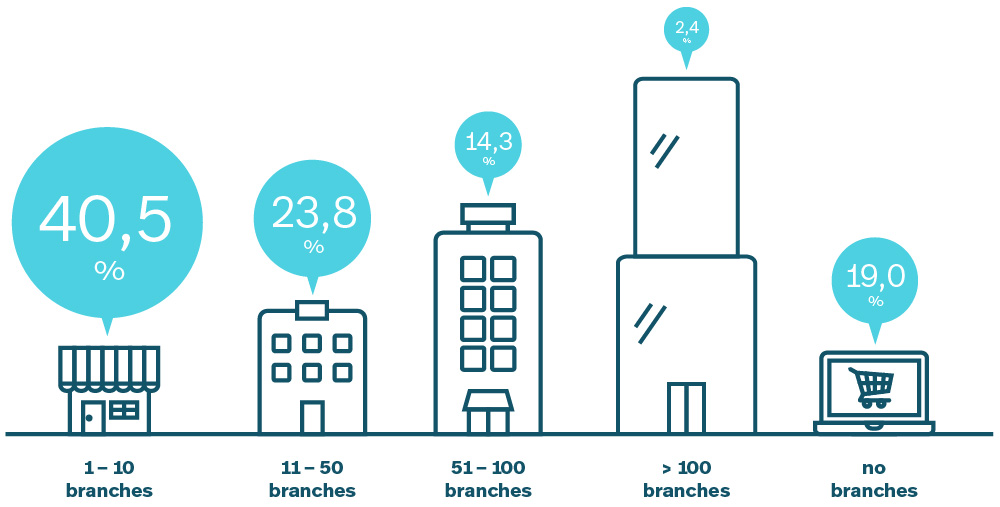

The focus of the first survey in late 2021 was primarily on small and medium-sized companies in Switzerland: 40.5% of participants have 1–10 locations, 23.8% have 11–50 locations, and 17% have more than 51 locations. A total of 84 retail companies participated in this first survey.

The results of the survey were presented on 18 January 2022 in a webinar. The participants have received all results in a PDF document.

We have summarised below the main findings of the first survey from our point of view.

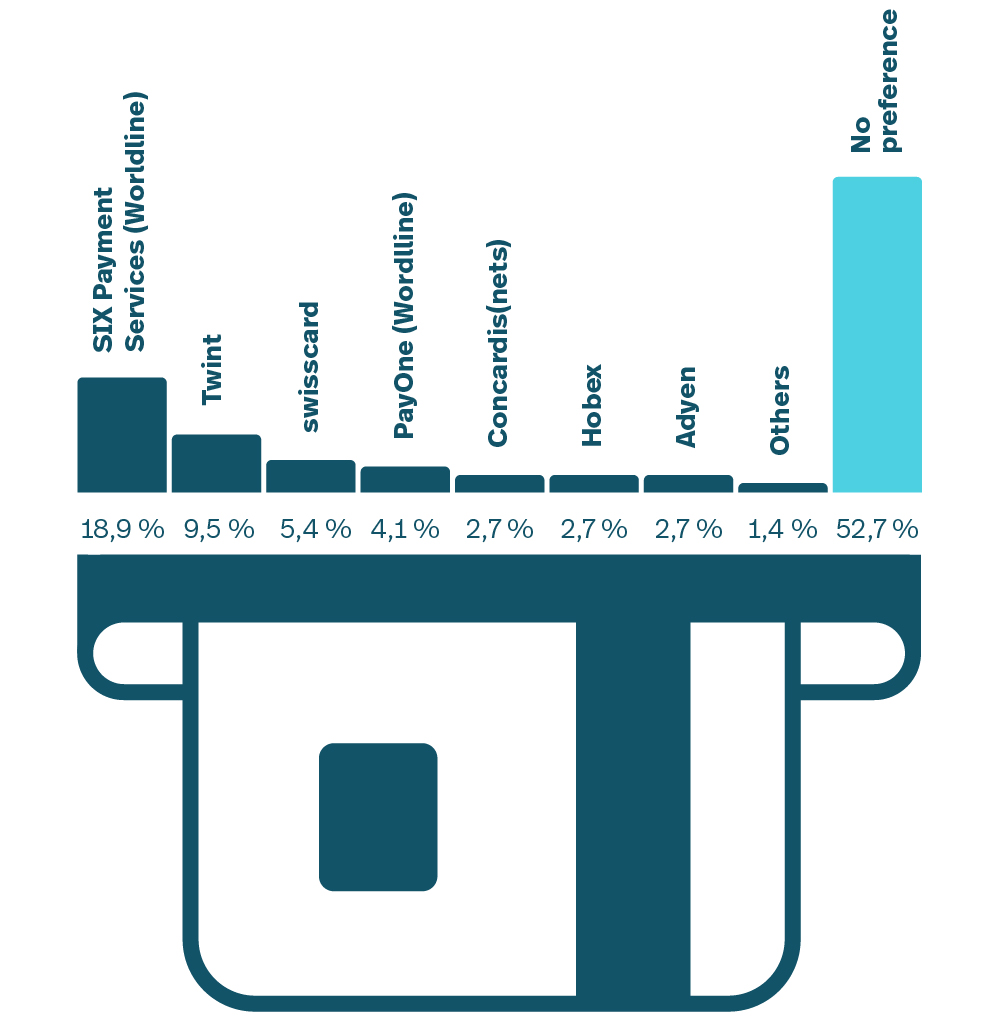

Surprisingly, 53% of the survey participants had no preference as to the acquirer. In turn, the main reasons for preferring cooperation were hardly surprising: they include broad card acceptance, service, and good value for money.

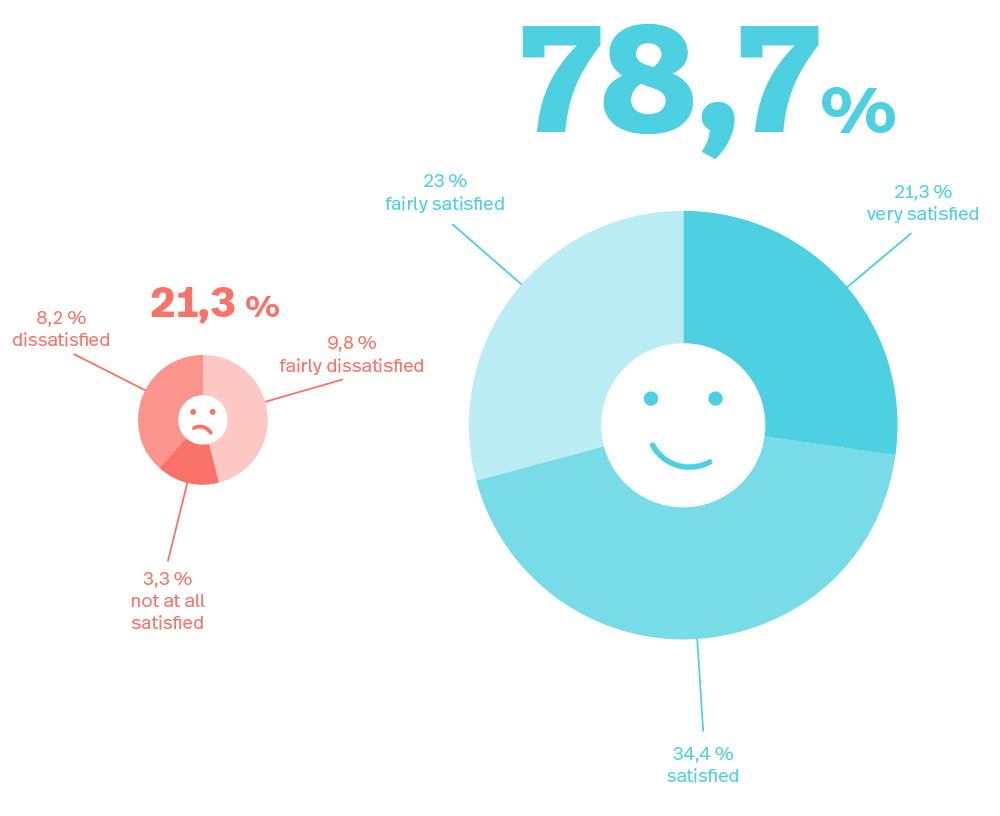

78.7% of the participants were fairly satisfied, satisfied, or even very satisfied with the cooperation with their acquirer. The main reason given for this was the seamlessness of processes. 21.3% of the participants were dissatisfied with their acquirer. The main reasons given for this were pricing and conditions.

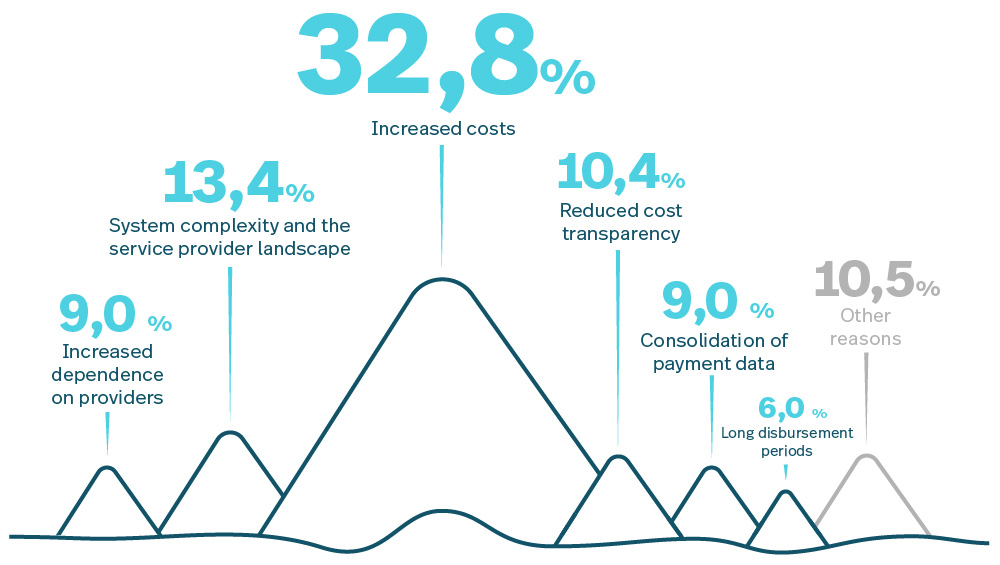

The three biggest challenges for companies when it comes to cashless payments at the POS were increased costs of payments (41.4%), an increasing dependence of retail companies on payment service providers (38.6%), and system complexity and the service provider landscape (53.7%).

The response to the Swiss EFT Insights has exceeded expectations: Not only did the webinar participants show a lot of interest, but we also received a lot of positive feedback about the importance and relevance of the survey to the market as a whole.

There is a growing awareness that more and deeper insights help retail companies to better understand this key part of their business.

For this reason, we will also conduct a follow-up survey in 2022 – this time with even more participants, including from large companies. Incidentally: Numerous Swiss associations have already pledged their support to the Swiss EFT Insights 2022.

Interested? Then sign up for our survey per this form right now. We will inform you immediately as soon as the new survey starts – most likely in autumn 2022.

Dominique is the CEO of treibauf AG and an expert in all the strategic challenges facing the EFT market. She is also able to draw on many years of experience as an analyst and strategist. She reports here regularly about the most significant trends and developments for the industry.

23 April 2024 – What are the 15 most important KPIs in accounting? And which new KPIs have become more important in the context of electronic payments? Our article provides valuable insights for better controlling. Continue reading

21 March 2024 – What do you actually do with your expired debit cards, credit cards and railcards? They’re simply too good to throw away. If you want to quickly make something practical, surprise your colleagues or bring a little light relief to your next customer meeting, we’ve got three upcycling ideas for ... Continue reading

7 December 2023 – «For us Pepper works like a universal adapter, which makes it vastly easier to connect different terminal types», says Rüdiger Boesen, Product Management TCPOS at Zucchetti, summarising his understanding of the software. A general contract was consequently concluded for the DACH region back at the start of the 2000s. Continue reading